2025 Fica And Medicare Rates

Blog2025 Fica And Medicare Rates - How Much Is Medicare Deductible For 2025 Anthe Jennilee, The 2025 medicare tax rate is 2.9% total. Maximum taxable amount for social security tax (fica), in 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2025. Cost Of Medicare Part C In 2025 Avrit Carlene, Maximum taxable amount for social security tax (fica), in 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2025. Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act.

How Much Is Medicare Deductible For 2025 Anthe Jennilee, The 2025 medicare tax rate is 2.9% total. Maximum taxable amount for social security tax (fica), in 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2025.

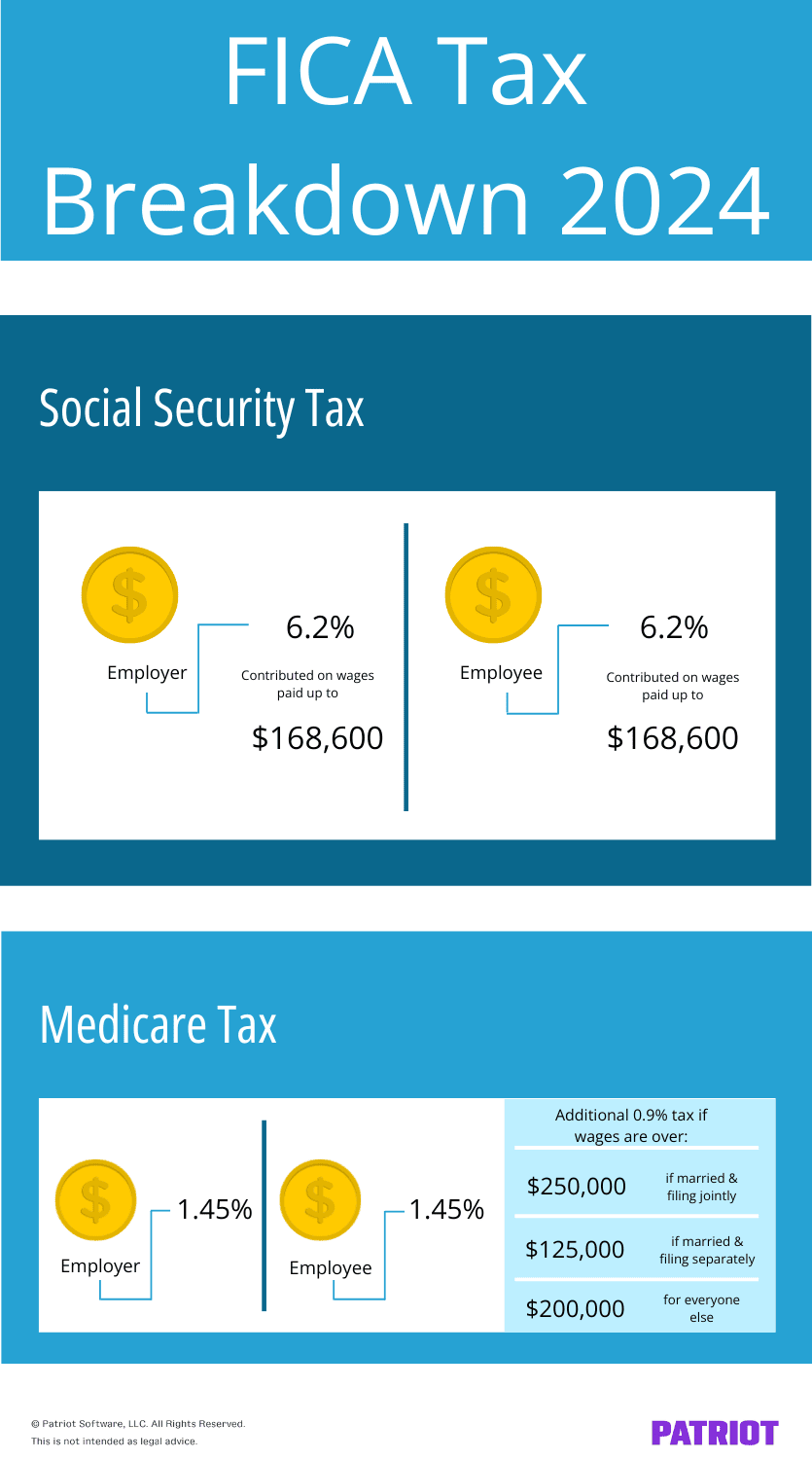

Social Security And Medicare Withholding Rates 2025 Berri Guillema, This includes a social security tax rate of 12.4% on earnings up to $168,600 in 2025 and a medicare tax rate of 2.9% without an earnings. Medicare tax rate for 2025:

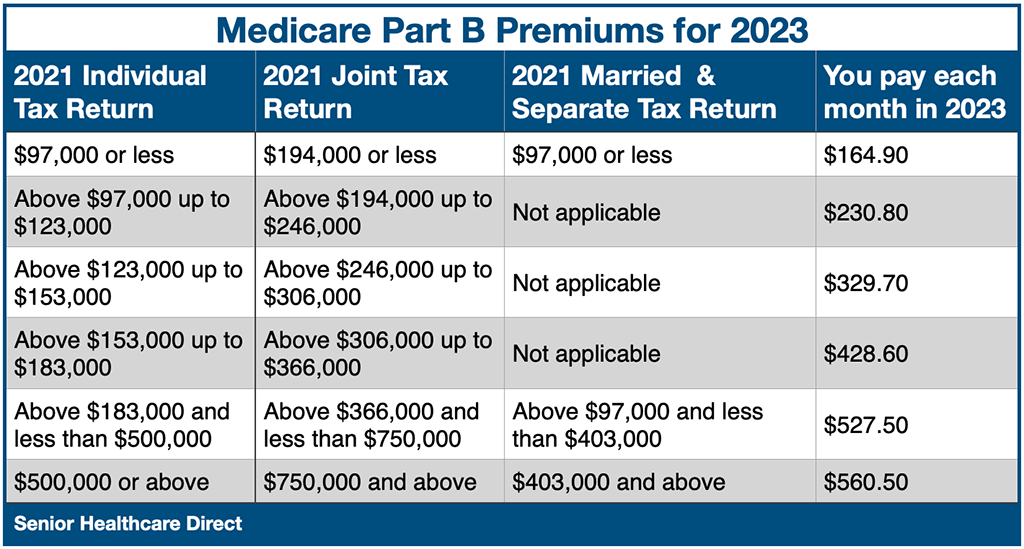

Medicare Part B Premium 2025 Cost Chart, Medicare tax calculator 2025 myrah tiphany, the maximum. The maximum fica tax rate for 2025 is 6.2%.

2025 Fica And Medicare Rates. What are the fica and medicare rates for 2025. In 2025, only the first $168,600 of your earnings are subject to the social security tax.

Medicare Plans 2025 Comparison Amelie Kristine, The 2025 rate for the medicare tax is set at 1.45% of an employee’s gross earnings, and the employer portion matches that 1.45%. The social security wage cap will be increased from the 2025 limit of $160,200 to the new 2025 limit of $168,600.

The 2025 rate for the medicare tax is set at 1.45% of an employee’s gross earnings, and the employer portion matches that 1.45%.

Social security taxes are the 6.2% taken out of your paycheck each month (up to $168,600, the 2025 taxable maximum) while fica refers to the combination of social security and.

Estimated Medicare Part B For 2025 Image to u, The federal insurance contributions act. Both employees and employers contribute to fica tax, with a combined rate of 15.3%.

What Is The Fica And Medicare Rate For 2025 Delia Giuditta, What are the fica and medicare rates for 2025. How to check fica medicare refund, for 2025, the fica tax rate for both employers.

Medicare tax calculator 2025 myrah tiphany, the maximum. What are the fica and medicare rates for 2025.

2025 Medicare Costs Expect to See a Slight Increase, That is a total of 7.65% for each party or 15.3% for both parties. Social security and medicare tax for 2025.

Understanding FICA, Social Security, and Medicare Taxes, You can calculate your fica taxes by multiplying your gross wages by the current social security and medicare tax rates. You’re responsible for paying half of this total medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

Attention to detail is important when discussing fica rates and limits, as they may change each calendar year.

Fica And Medicare Rates 2025 Ferne Jennine, This includes a social security tax rate of 12.4% on earnings up to $168,600 in 2025 and a medicare tax rate of 2.9% without an earnings. The employee’s portion is deducted from their.

Maximum taxable amount for social security tax (fica), in 2025, the medicare tax rate for employers and employees is 1.45% of all wages, unchanged from 2025.